Introduction In the vibrant tapestry of Africa, brimming with potential and diverse cultures, entrepreneurship stands as a powerful tool for economic transformation. This dynamic force is pivotal for stimulating economic growth, offering solutions to unemployment, and enhancing the quality of life. This blog explores the transformative role of entrepreneurship in Africa’s economic landscape and examines global government policies that successfully support such initiatives.

The Role of Entrepreneurship in Economic Development Entrepreneurship is a key driver of economic growth. It fosters innovation, creates job opportunities, and can effectively address socio-economic issues like poverty. Entrepreneurs introduce new ideas to the market, enhancing competitiveness and propelling industries forward. Their ventures, therefore, are not just business entities but catalysts for change.

Global Government Policies Supporting Entrepreneurship Governments around the world have recognized the importance of nurturing entrepreneurship. Here are some successful strategies:

- Funding Access: In South Korea, the government has established several funds specifically for startups, providing the financial support needed for early-stage growth. Similarly, Israel’s innovation authority offers various grants and incentives for research and development.

- Education and Training: Finland’s education system, renowned for its innovation, integrates entrepreneurial learning from a young age. Singapore’s focus on lifelong learning and skill development also provides a solid foundation for aspiring entrepreneurs.

- Tax Incentives and Grants: Ireland’s friendly tax environment for businesses, especially for start-ups, has attracted entrepreneurs globally. Canada’s Scientific Research and Experimental Development (SR&ED) program provides tax incentives to encourage businesses to conduct research and development.

- Streamlining Regulations: New Zealand’s easy and straightforward process for starting a business has made it a top destination for entrepreneurs. Australia’s reduction in bureaucratic red tape has significantly improved its business environment.

Entrepreneurship in Africa: Current Landscape and Success Stories Africa is witnessing a surge in entrepreneurial ventures, from tech startups in Kenya’s Silicon Savannah to agribusinesses in Nigeria. Governments across the continent are increasingly acknowledging the role of entrepreneurship in economic development. For instance, Rwanda’s focus on creating a business-friendly environment has led to a significant increase in entrepreneurial activities.

Policy Recommendations for African Governments African governments can foster a nurturing environment for entrepreneurship through several strategies:

- Develop Tailored Policies: Given Africa’s diverse economic landscapes, policies need to be customized to suit local needs.

- Enhance Access to Finance: Implement funding initiatives, including grants and venture capital, tailored for African entrepreneurs.

- Invest in Entrepreneurial Education: Integrating entrepreneurship in the education system and offering training programs can build a robust entrepreneurial culture.

- Create a Supportive Regulatory Environment: Simplifying the business registration process and offering tax breaks can encourage more individuals to start businesses.

- Foster Private-Public Partnerships: Collaborations can lead to innovative solutions and support for the entrepreneurial ecosystem.

- Encourage Technological Innovation: Supporting tech startups with infrastructure and funding can lead to rapid growth and scalability.

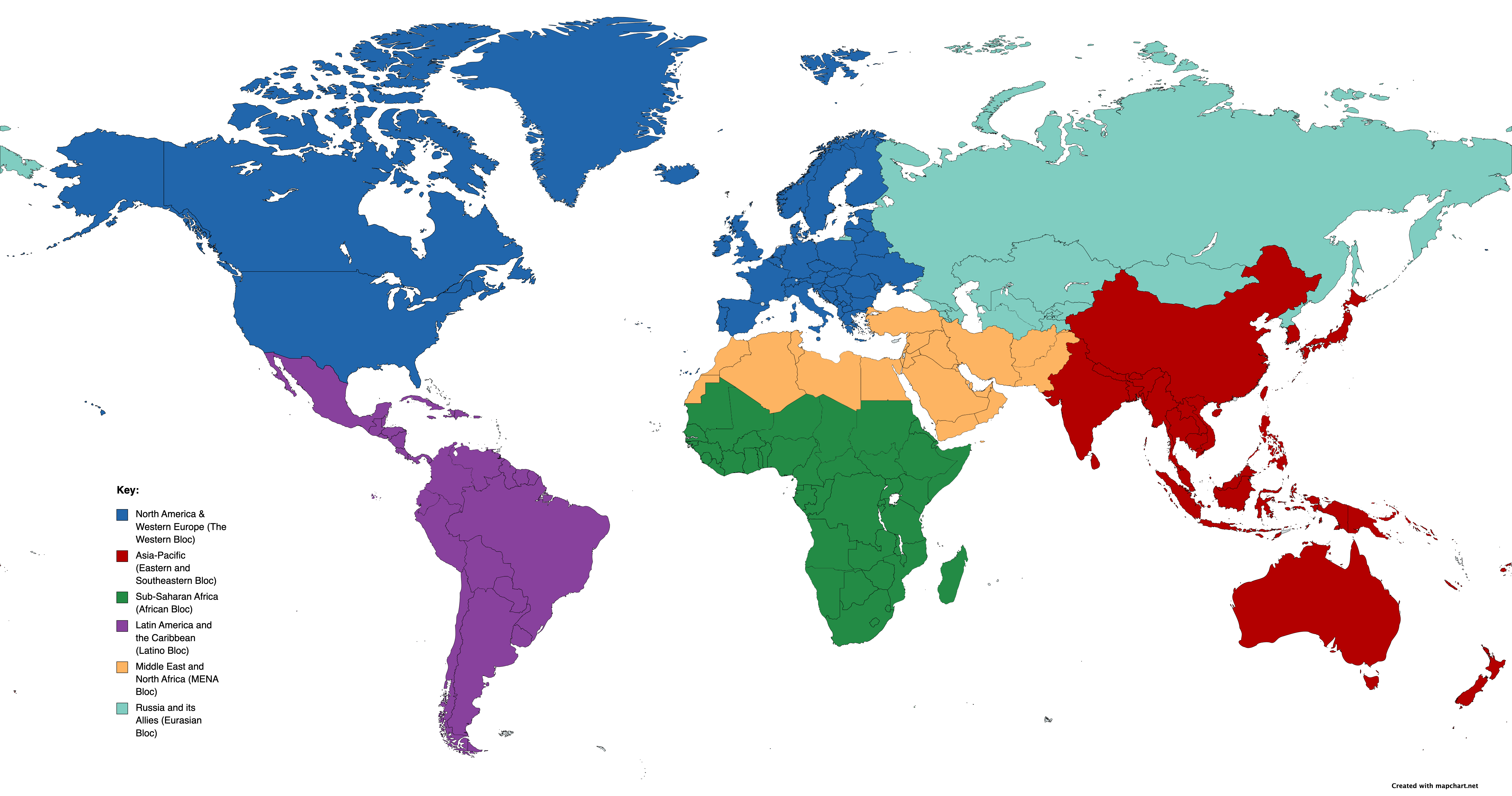

The Role of International Collaboration Partnerships with global institutions can bring additional knowledge, funding, and support, helping to amplify local entrepreneurial efforts.

Conclusion Entrepreneurship holds the key to transforming Africa’s economic landscape. With strategic policies, education, and support, African nations can unlock the potential of their entrepreneurs, propelling the continent towards a prosperous and innovative future.

This expanded version now encompasses a more detailed analysis, specific examples, and a comprehensive look at how entrepreneurship can drive economic development in Africa.