The New Oil

In the modern digital landscape, data isn’t just valuable—it’s transformative. Dubbed the “new oil,” data by British mathematician Clive Humby in 2006. Data is to the information age what oil was to the industrial revolution: an absolute game-changer. For entrepreneurs, mastering data isn’t just beneficial—it’s essential. From tech startups to local cafes, and from e-commerce giants to boutique stores, data-driven decisions are the backbone of success. Dive with us into the undeniable power of data and discover how it can redefine the future of your business.

Why is Data Important for Entrepreneurs?

Informed Decision Making:

Data provides factual insights, eliminating the need for guesswork. When you have concrete numbers and trends at your fingertips, you can make decisions with confidence. For instance, sales data can help you identify which products are most popular, allowing you to focus your efforts on what truly resonates with your customers.

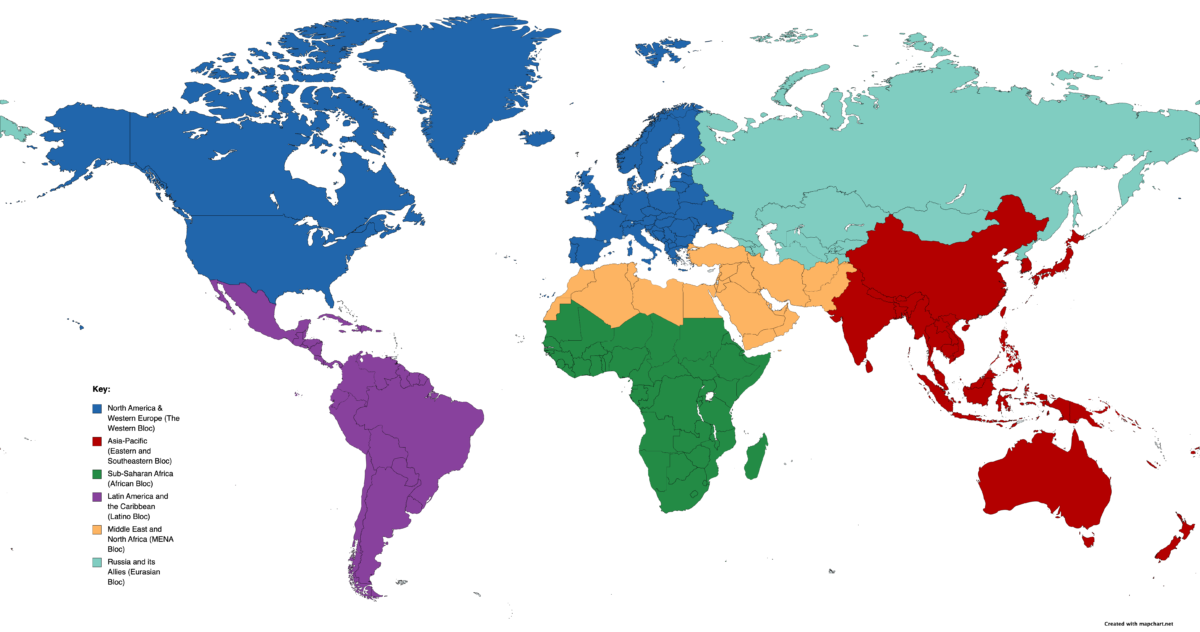

Understanding Your Market:

Before diving into a business, it’s essential to understand the landscape. Market research data can provide insights into consumer preferences, potential gaps in the market, and the competitive landscape. This knowledge ensures that you’re not entering a saturated market blindly or missing out on a niche opportunity.

Tailored Marketing Strategies:

With data on customer demographics and online behavior, you can create targeted marketing campaigns. Instead of casting a wide net, data allows you to focus on those most likely to convert, ensuring a higher return on investment for your marketing efforts.

Financial Health Monitoring:

Keeping a close eye on financial data helps entrepreneurs monitor profitability, manage expenses, and forecast future financial needs. This proactive approach can prevent potential financial pitfalls.

Continuous Improvement:

Customer feedback and reviews provide a goldmine of information. By actively seeking and analyzing this feedback, businesses can continually refine their offerings, leading to enhanced customer satisfaction and loyalty.

Harnessing Data as a New Business Owner

Starting a new business can be overwhelming, with a plethora of tasks demanding your attention. Amidst this chaos, it’s easy to overlook the importance of data collection. However, the early stages of a business are when data can be most impactful. By establishing a strong data-driven foundation from the outset, you set the stage for informed growth and evolution.

Steps to kickstart your data journey

Invest in Tools: There are numerous tools available, from Google Analytics for website insights to accounting software for financial data. These tools automate data collection, allowing you to focus on analysis and application.

Stay Updated: The business world is dynamic, with consumer preferences, market trends, and even legal regulations constantly evolving. Regularly reviewing your data ensures you stay ahead of the curve.

Prioritize Data Quality: Not all data is useful. Ensure that what you’re collecting is relevant, accurate, and timely. Quality trumps quantity when it comes to actionable insights.

Educate Yourself: Data is only as valuable as your ability to interpret it. Consider taking courses on data analysis or hiring experts if necessary.

Conclusion

In the fast-paced world of entrepreneurship, data stands as a beacon of clarity amidst the fog of uncertainty. It’s more than mere numbers; it’s the pulse of your business, echoing its vitality and potential. As you navigate the thrilling waters of entrepreneurship, let data be your compass, guiding your strategies and decisions. And if you’re hungry for more insights on mastering the entrepreneurial journey, delve deeper into the treasure trove of knowledge at this blog. From understanding the quintessential trajectory of an entrepreneur to exploring the nuances of civic and political entrepreneurship, there’s a wealth of wisdom waiting to be unlocked. Embrace a data-driven mindset, and let it be the wind beneath your entrepreneurial wings, propelling you towards success in an ever-evolving business landscape.